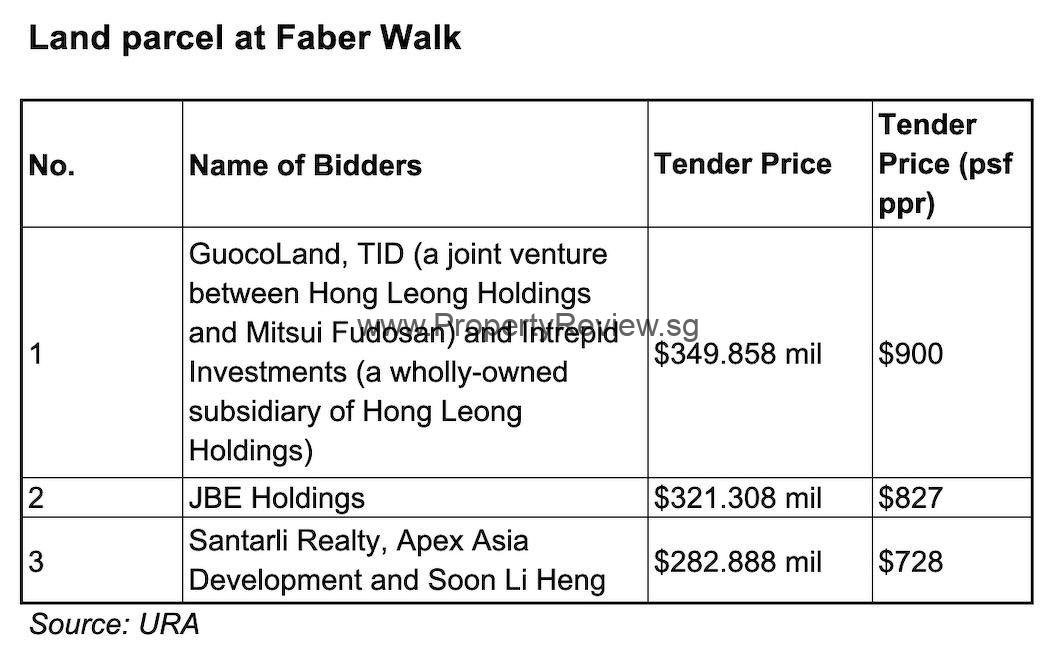

There were three offers for the Government Land Sale (GLS) home plot at Faber Walk when it closed on November 19. A joint venture consisting of GuocoLand, TID Residential (a joint venture between Hong Leong Holdings and Mitsui Fudosan) and Intrepid Investments (a wholly-owned subsidiary of Hong Leong Holdings) put the top bid of $349.858 million or $900 psf per plot ratio.

The 99-year leasehold 277,659 sq ft Clementi property may be developed into a new 400-unit residential complex with a maximum gross floor area (GFA) of 388,728 sq ft. Its zoning is for non-landed residential use.

Surrounded by vegetation and close to the Rail Corridor, the GLS site lies next to the Faber Heights landed housing complex. Given their acquisition of the 344,700 square foot, 99-year leasehold property along Upper Thomson in April this year, GuocoLand may have found great appeal here. With an offer of $779.6 million ($105 psf ppr), GuocoLand and joint venture partner Hong Leong Holding placed the lone bid for the property and prevailed.

“If approved, we intend to create a waterfront development including several low-rise blocks with up to 403 residential units in this private residential enclave,” says a GuocoLand spokeswoman. After our recent projects in the CBD, the East and the North of Singapore with our Lentor Hills projects and our upcoming project at Upper Thomson Road, we look forward to introduce GuocoLand’s developments in the West of Singapore.

GuocoLand claims that the property is adjacent to employment hubs such Jurong Lake District, which is estimated to generate 100,000 new jobs, the International Business Park and Jurong Innovation District. Apart from various foreign schools, the campus is close to existing institutions such Nan Hua Primary School, Nan Hua High School, NUS High School of Math & Science, and higher education establishments including the National University of Singapore.

Just one stop from the Jurong East MRT interchange station, the spokesperson says, residents of the future property will be able to stroll to the forthcoming Jurong Town Hall MRT station on the Jurong Region Line. The site is also near a number of nature parks and facilities, including the forthcoming Old Jurong Line Nature Trail, which is part of an 18km green recreational network within the new Clementi Nature Corridor linking residents to the Jurong Lake Gardens and the Rail Corridor’, the GuocoLand spokesman notes.

At $900 psf ppr, the maximum bid is 8.9% more than the second highest proposal of $827 psf pr sent by privately held JBE Holdings located in Singapore under property developer Patrick Lam. The Commodore, a prior development by JBE, consists of 219 units Originally opened in November 2021, the 99-year leasehold apartment close to the Canberra MRT Station is now completely sold.

Comprising Santarli Realty, Apex Asia Development, and Soon Li Heng, a partnership made the third and lowest offer of $728 psf ppr.

Mohan Sandgeran, head of research and data analytics at SRI, notes that the first and second highest bids speak to the developer’s great interest and competitive posture in acquiring the land.

He does, however, observe that the Faber Walk site got barely half the bids for the Clementi Avenue 1 GLS site, which got six bids at the closing of the bidding in November 2023. With a $1,250 psf ppr offer, CSC Land Group and MCL Land obtained the 178,066 square foot, 99-year leasehold land.

Sandgeran notes that the lower plot ratio of 1.4 for the Faber Walk GLS site compared to Clementi Avenue 1 results in fewer offers. “This lower plot ratio limits the possible building height and lowers the total development yield of the site,” he explains.

Mark Yip, CEO of Huttons Asia, notes that the bid of $900 psf ppr exceeds the $850 psf pr paid for the 99-year leasehold Park West condo property acquired en bloc in 2018.

According to Yip, the take-up at recent Nov 2024 launches might indicate better market mood. Moreover, the perspective on interest rates seems to be declining, which would encourage more people to invest in homes. This might have produced the confident offer for the remaining piece of land in the Faber exclusive residential enclave.

West Coast Vale was the latest GLS site sold in the region; City Developments acquired a land lot for $472.4 million ($800 psf ppr) in February 2018. Launched in November 2018 and totally sold in October 2021, the Whistler Grand project The average selling price reached altogether more than $1, 430 psf ppr.

Ismail Gafoor, CEO of PropNex, believes developers’ interest in the Faber Walk GLS site could be related to the positive launch performance of the three condo projects along West Coast Vale: the 752-unit Parc Riviera by EL Development, followed by the 520-unit Twin Vew by CSC Land Group and the 716-unit Whistler Grand. All three are sold out completely.

Gafoor projects that at the current Faber Walk location, the average selling price of future residences at a land pricing of $900 psf might perhaps come in at about $2,200 psf.

Minutes from the Clementi MRT station on the East-West Line lies the Faber Walk GLS site. It also is close to the Ayer Rajah and Pan Island motorways.