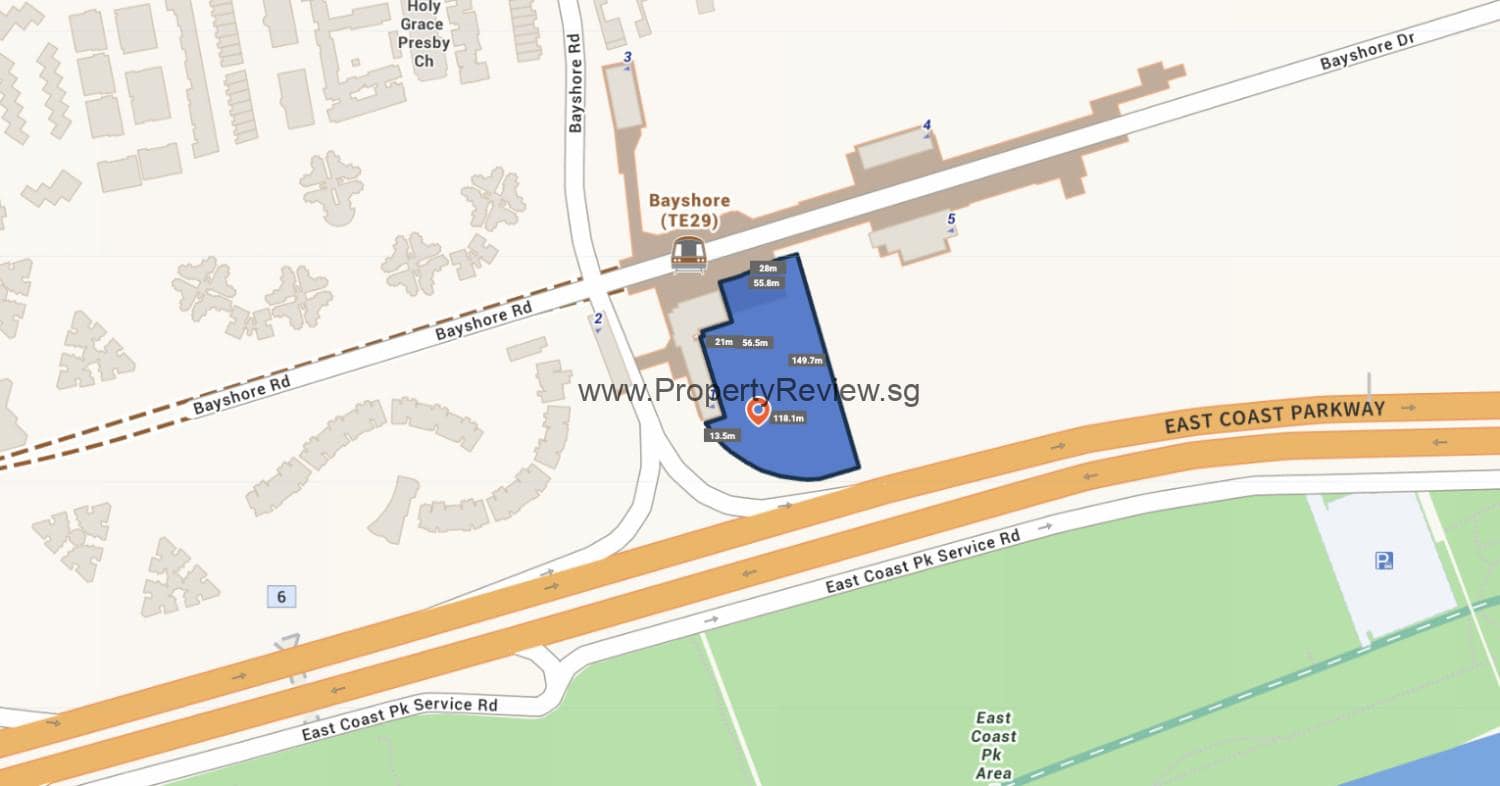

URA has started the bidding for a Government Land Sale (GLS) residential site at Bayshore Road. Situated just beside the Thomson-East Coast Line (TEL), the 112,992 square foot, 99-year leasehold property is allocated for residential development with a maximum GFA of 474,570 sq ft near to the Bayshore MRT Station. It may built a total of 515 houses. The location falls on the Confirmed List of the 2H2024 GLS Program.

Comprising a 60-ha estate between the East Coast Parkway (ECP) and Upper East Coast Road, this Bayshore GLS is the first private residential site in the forthcoming Bayshore zone, on reclaimed ground. Over 10,000 additional dwellings will be constructed on the estate in the next years; thirty percent of them are set aside for private residence.

The land could be the first private home site with sea views and doorstep access to an MRT Station, observes Mark Yip, CEO of Huttons Asia. Given its connection, he expects the new property at the site will appeal to purchasers because residents could reach the downtown area in 20 minutes via the TEL. The property also has access to the ECP, thereby enabling a 15-minute automobile trip to the CBD.

Along Bayshore Drive, other facilities like stores, restaurants and sports venues scheduled to be built will be developed in the vicinity. One stop away, there will be mixed commercial and residential development above Bedok South MRT Station in the future,” Yip notes. Schools like Temasek Primary School, Temasek Secondary School, and Temasek Junior College are one km to two kilometres around the location.

The Bayshore area has planned around 7,000 HDB flats. Launched for sale in the October BTO exercise last month, the first Build- To- Order (BTO) project consists of 1,440 two-room up to four-room apartments spread across two projects.

At the two Bayshore developments, there were approximately 5,000 applications for the 1,006 four-room apartments, meaning an application rate over five times. “The great demand confirms the appeal of living close to the East Coast,” Yip notes. With a peak price of up to $570 million or over $1,200 psf per plot ratio, he expects the Bayshore Road GLS property may draw in much to four bids from developers given demand.

Marcus Chu, CEO of ERA Singapore, thinks the upcoming building at the site would draw interest from neighbouring present private condo owners seeking upgrades. Homeowners in neighbouring landed residential enclaves like the Kew and Sennett estates wishing to right-size might potentially help demand.

He also notes that in April 2017 the 841-unit Seaside Residences on Siglap Road was the last new launch in the area. During its inaugural weekend, the property saw 70% of the 560 units issued snapped up at an average selling price of around $1,700 psf.

Chu notes, “despite headwinds developers in the market face, the Bayshore site could be the land parcel many developers have been waiting for this year.” With offer costs ranging from at least $500 million to $1,050 psf ppr, he projects the location will garner four to six bids.