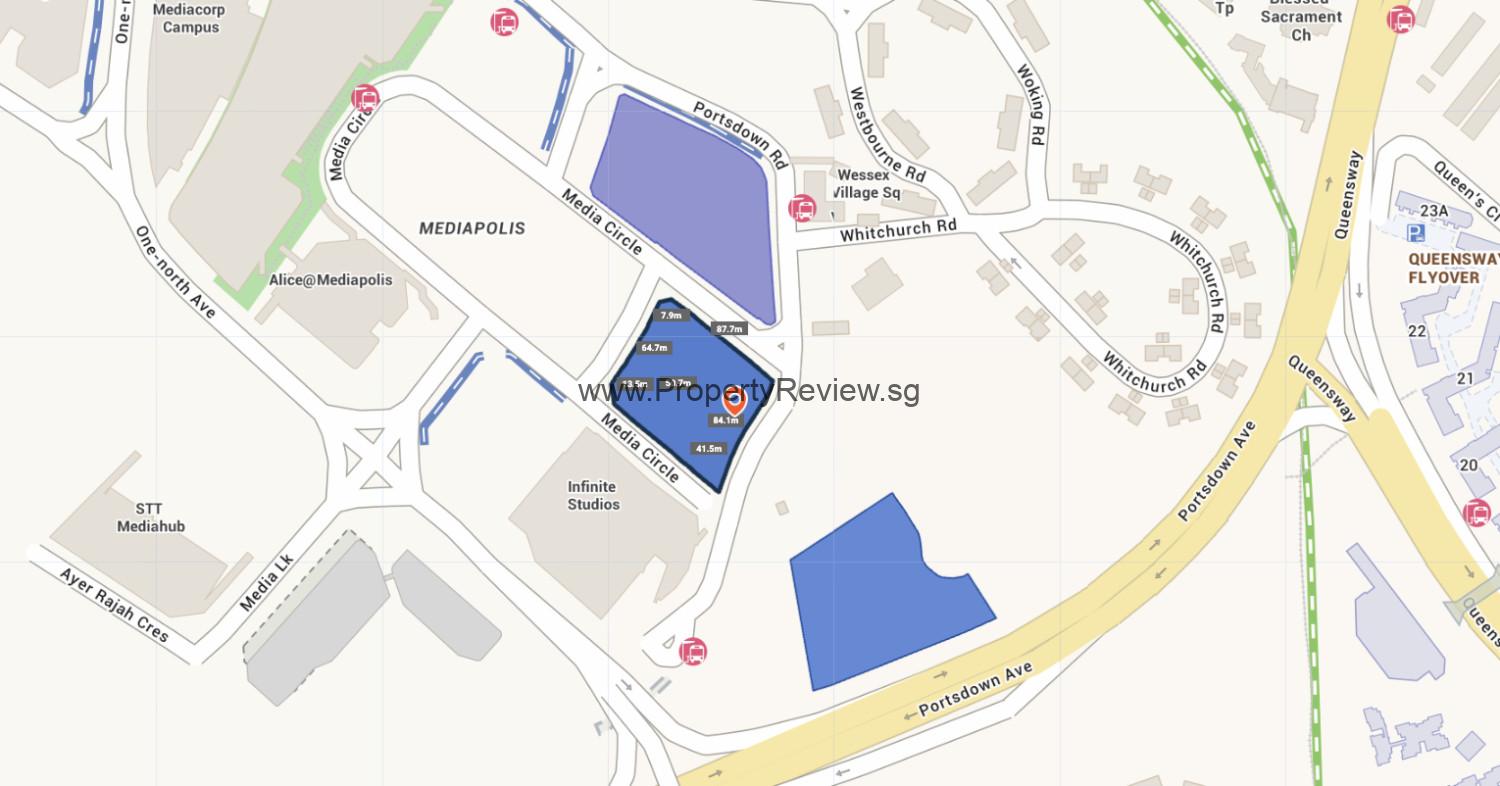

Launched on November 2024 under the 2H2024 Government Land Sale (GLS) Program, the bids for two plots situated along Media Circle GLS were Under the Confirmed List, both 99-year leasehold lands are zone under residential with commercial at the first story.

Media Circle (Parcel A) is midway between Media Walk and Media Circle. With an 82,125 square foot maximum gross floor area (GFA), it may possibly produce around 325 homes. Measuring around 107,936 sq ft and with a maximum GFA of 464,129 sq ft, the neighbouring Media Circle (Parcel B) It could build about 500 homes.

The locations are towards the southernmost point of the one-north territory. Media Circle was essentially created as a commercial and IT park’, ERA Singapore CEO Marcus Chu explains. “This means the immediate area might not have enough facilities to sustain a residential enclave.”

The planned project might be a welcome addition to the already limited choices for professionals living in one-north. “Current housing options in the one-north area mostly revolve around co-living spaces, serviced apartments and hotels,” notes Chu.

The planned project at the site would be well positioned to leverage the tenant pool consisting of workers in one-north, Science Park, and the National University of Singapore, notes Mark Yip, CEO of Huttons Asia. “Families with children studying in the nearby Tanglin Trust School may also be possible tenants,” he says.

Media Circles (Parcels A and B) will be closed next year on March 4 and April 29, respectively. According to Yip, the staggered closing dates would enable developers to track local interest and guide their tender bid preparation. With the highest offer of up to $494 million or between $1,000 and $1,101 psf ppr, he expects each site may draw in up to three bids.

Media Circle (Parcels A and B) has a less appealing location than past one-north area GLS sites, such Slim Barracks Rise (Parcel A), which is adjacent to the Buona Vista MRT Station, ERA’s Chu notes in a more cautious stance.

On Media Circle, a 114,462 square foot site was the most recently approved GLS site nearby. With a maximum offer of $395.29 million ($1,191 psf ppr), the property went to a joint venture consisting of Qingjian Realty and China Communications Construction Co., often known as Forsea Holdings in January. One could build a 355-unit complex out of the property.

Another bidding ended in September for a nearby 62,486 square foot residential land totally designated for long-stay serviced apartments. But URA deemed the lone proposal of $120.09 million ($461 psf ppr) offered by a group headed by Frasers Property “too low.”

Chu projects a “lukewarm response” to the two most recent Media Circle initiatives. “Developers might not be as eager to compete for the Media Circle sites since their buyer pool is smaller than that of most residential sites to leverage.” Developers could be more interested in other GLS sites on the Confirmed List, such the sites at Bayshore GLS and Chuan Grove GLS, he says.