Sim Lian Group’s companies Sim Lian Development and Sim Lian Land, are at the top of the list for the Dairy Farm Walk GLS site. The group put in a $347 million bid, which works out to $980 psf per acre (psf ppr).

There were bids at the end of the tender for Dairy Farm Walk, which is a government land sale (GLS).

About the Land Bid Results at Dairy Farm Walk

At $970 a square foot per year, a joint venture between United Engineers and the Soilbuild Group was the second-highest bid, says Nicholas Mak, head of research at ERA Realty. That’s just 1% lower than the top bid of $980 per square foot per year.

There is a land rate of $980 psf ppr for the Dairy Farm Walk residential site. This means that the new condo project could start at a price of $1,880 to $1,980 per square foot.

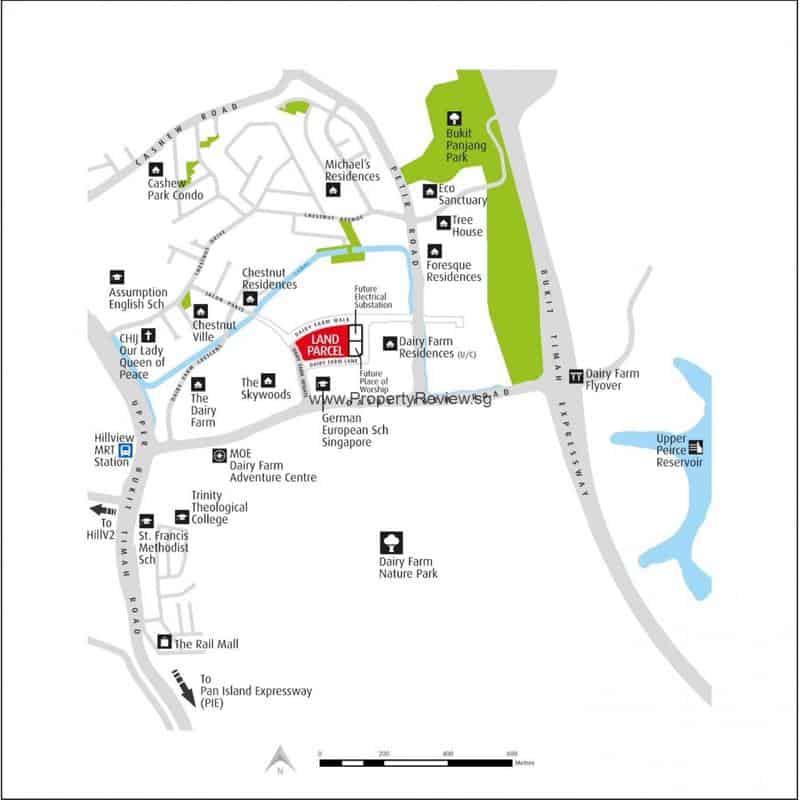

The 168,597 sq ft, 99-year leasehold site could be used to build 350 to 400 homes.

Developers who bid the second-highest amount on the Dairy Farm Walk GLS site are United Engineers Ltd. They are the developers of the 460-unit Dairy Farm Residences, which is just one street away. Condos with 99-year leases were first put on the market in late 2018. The average price for a unit is $1,612 per square foot, based on caveats that have been filed so far in that time frame.

PropNex say that the tenders for the two plots at Bukit Batok West Avenue 8 and Dairy Farm Walk have been very competitive because they are both in the Outside Central Region (OCR). Developers want to buy more land after last year’s strong sales of new homes. This is especially true for land near the OCR.

The number of new private homes that haven’t been sold in the OCR at the end of 2021 was 3,972. This is a record low, according to data from the URA. It could take less than a year to get rid of the rest of the mass market homes that aren’t sold if new OCR units (excluding ECs) are sold at that rate.

Also, Ong Teck Hui, senior director of research and consulting for JLL, says that the site’s medium size and $347 million price make it less risky than larger land parcels, which are more expensive. Developers are also interested in buying residential sites to add to their land banks because the number of private residential units that haven’t been sold is at a record low of 14,333 units as of 4Q2021.